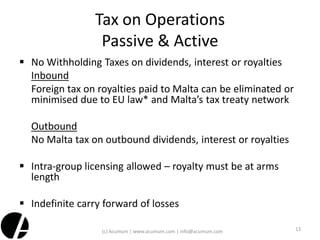

Malta - Intellectual Property & Royalty Services 0% Patent & Artistic Copyright Tax 1 Presentation provided for general informational purposes only; - ppt download

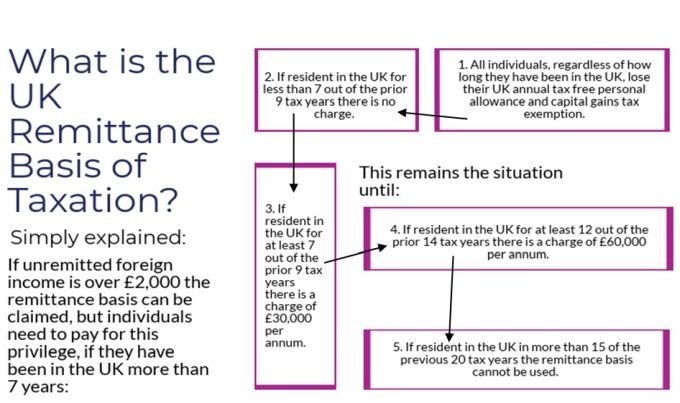

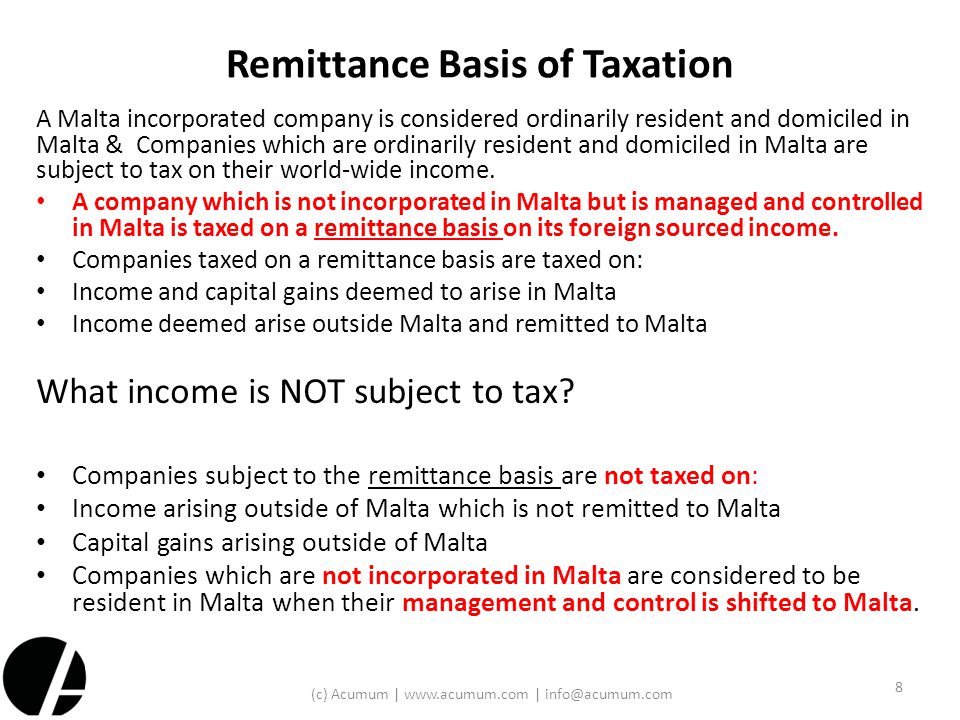

Malta: Commissioner publishes first ever guideline on remittance basis of taxation | International Tax Review

Malta residence visa: Golden Visa by Investment (MRVP), Requirement, Processing, Permanent residency in 2023 -

Digital Overseas - Settle in Malta CALL :- 8487996094 #education #malta #consultant #studygram #abroadvisa #abroadjobs #student #digital #consultancyservices #pathway #ahmedabadinstagram #india #withoutielts #studyinmalta #maltauniversity #studysafe ...